.png)

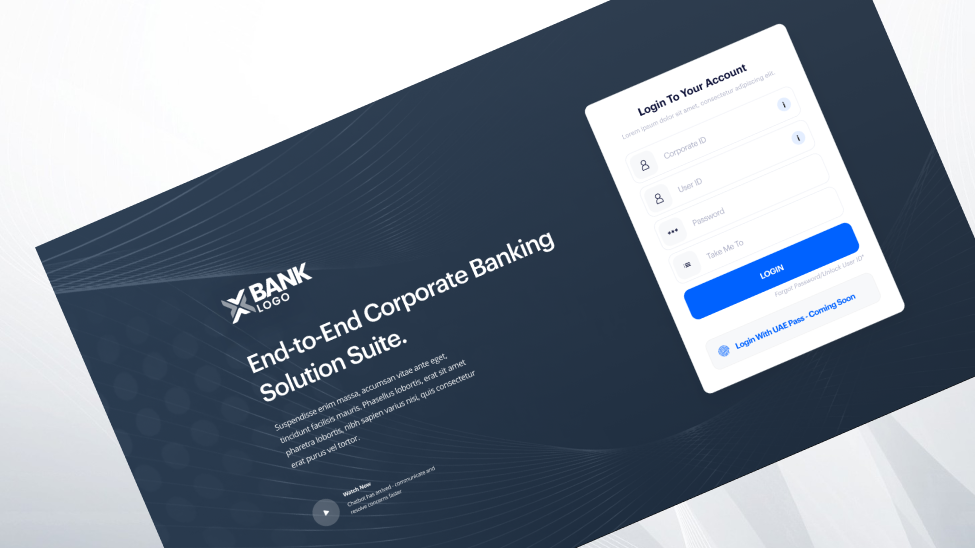

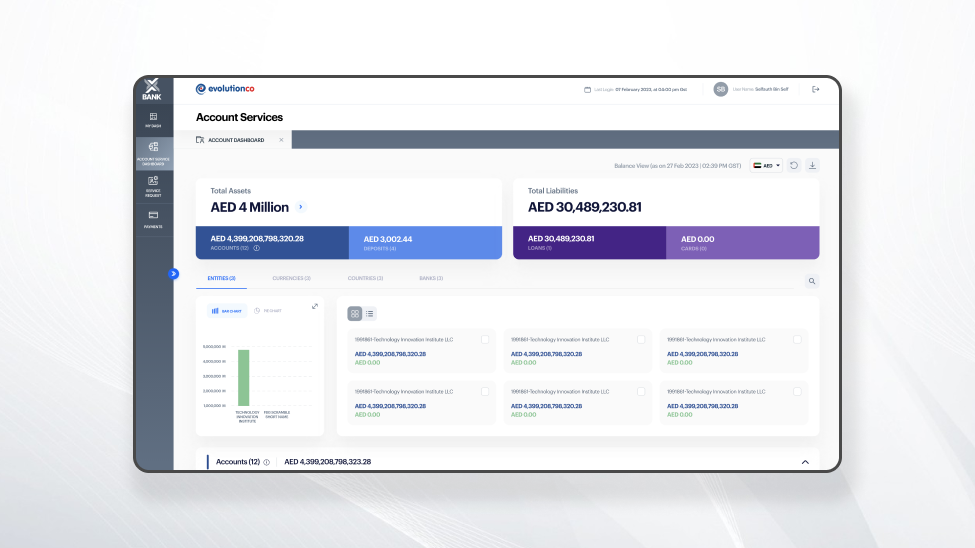

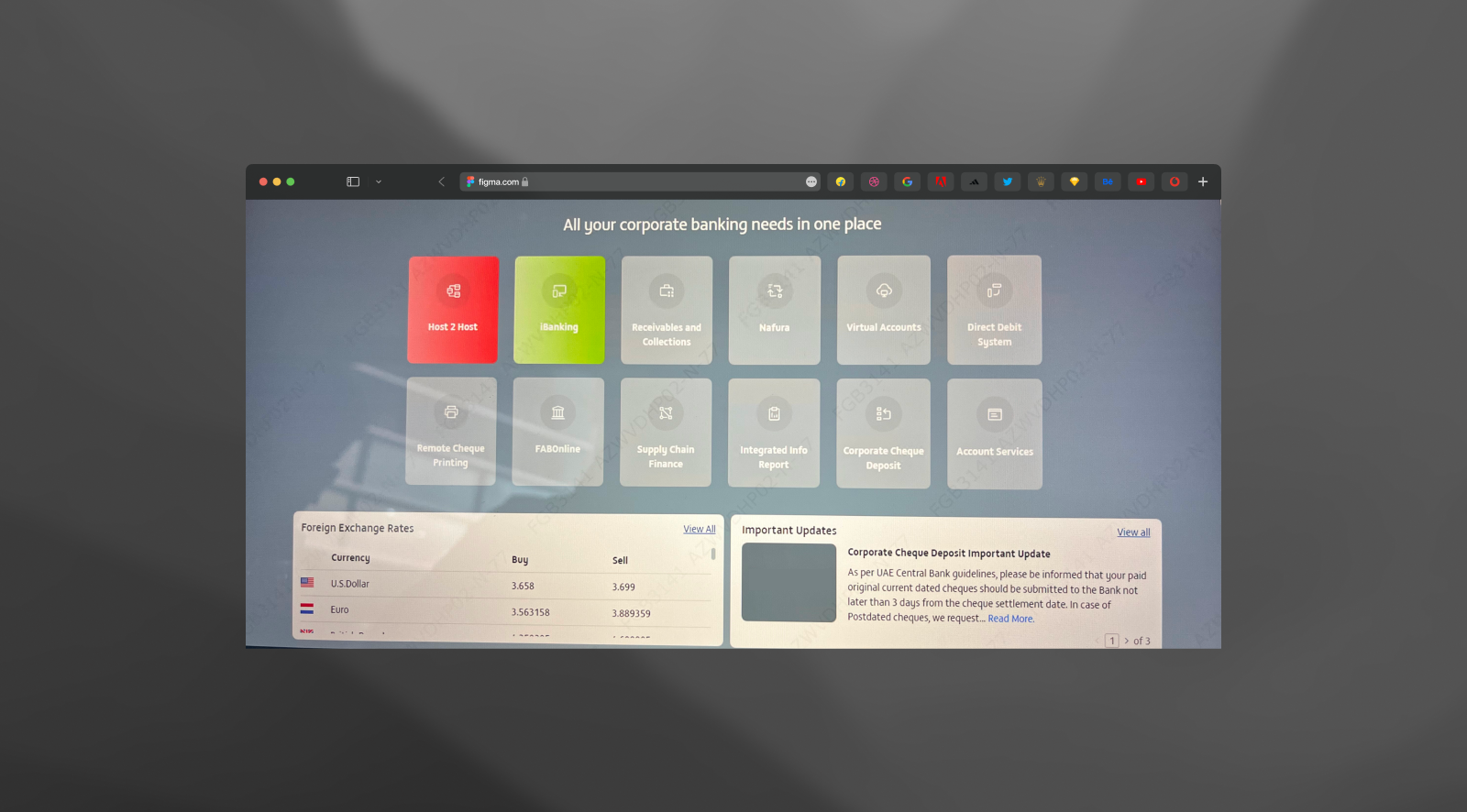

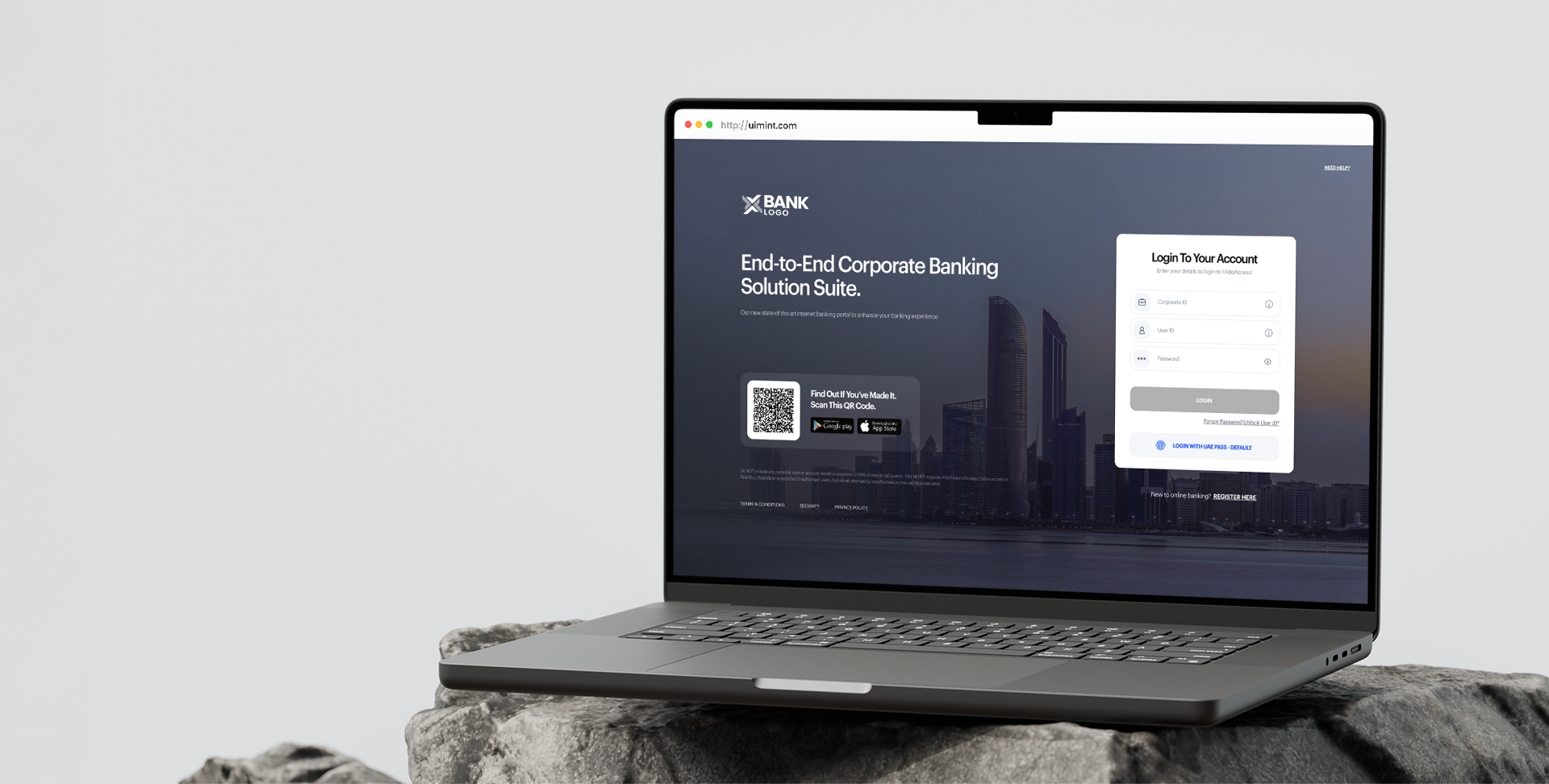

The largest bank in the UAE embarked on a comprehensive digital transformation of its corporate banking experience, streamlining complex processes and elevating usability. The initiative delivered role-based dashboards and a scalable design system across modules like GCN, Trade, Payments, Account Services, and more.

Strategic

Transformation

THE CHALLENGE

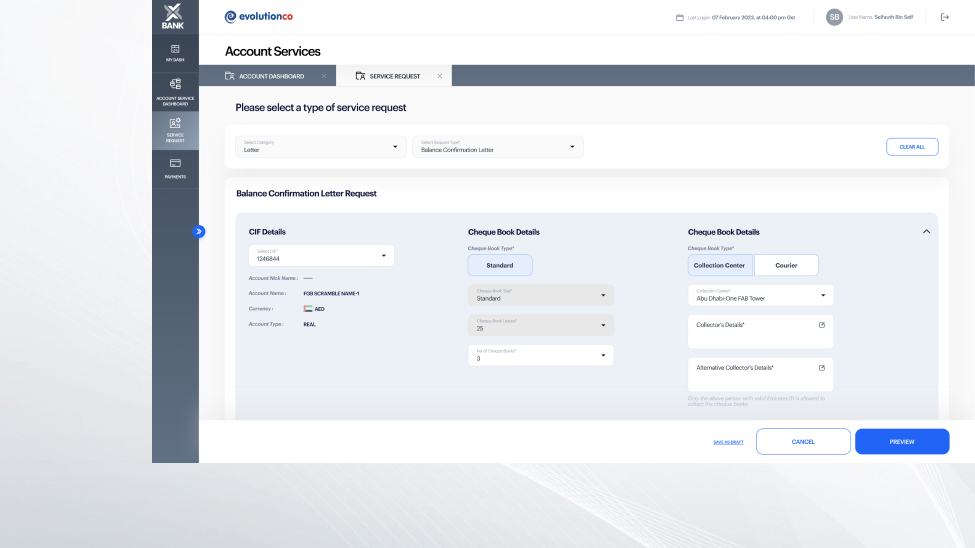

Multiple legacy modules like Payments, Trade, and Account Services operated in silos, creating inconsistent journeys . Users faced complex workflows, scattered navigation, and lacked consolidated dashboards or actionable insights, making financial tasks inefficient and time-consuming.

THE GOAL

Build a unified, role-based platform that streamlines journeys across modules, simplifies account operations, improves service request handling, and introduces dashboards with actionable insights to support smarter, faster financial decisions.

OUR APPROACH

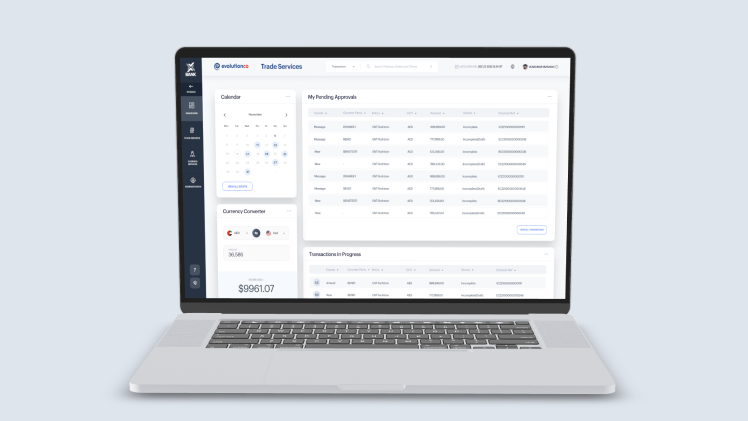

We partnered with stakeholders and global tech vendors to analyze workflows across 10+ modules. By mapping user roles like Maker, Checker, Verifier, and Self-Auth, we identified friction points, re-engineered flows, and designed scalable dashboards and interaction patterns.

THE OUTCOME

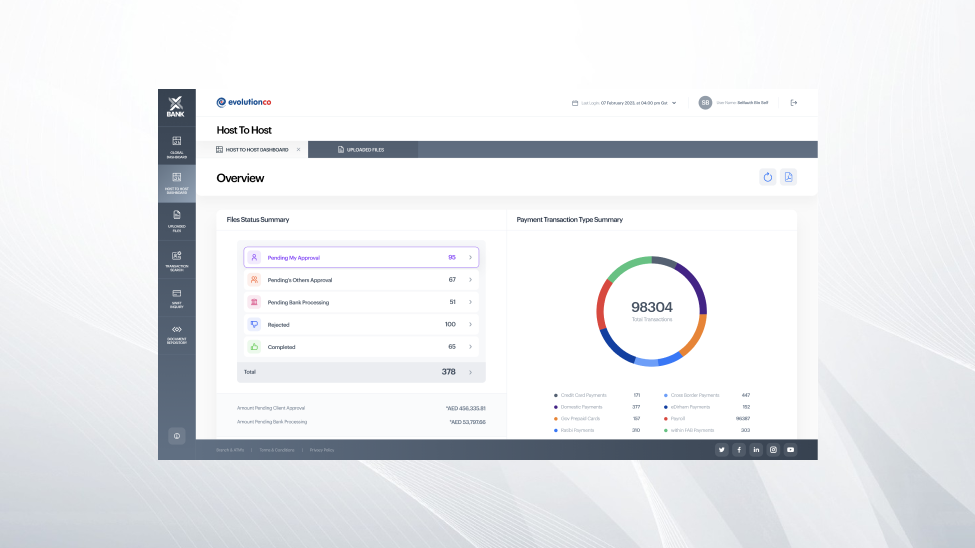

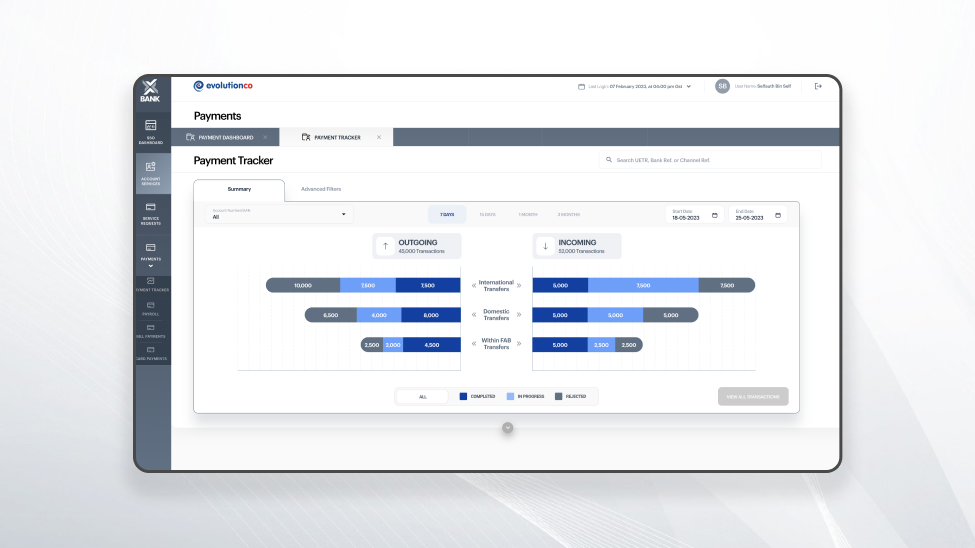

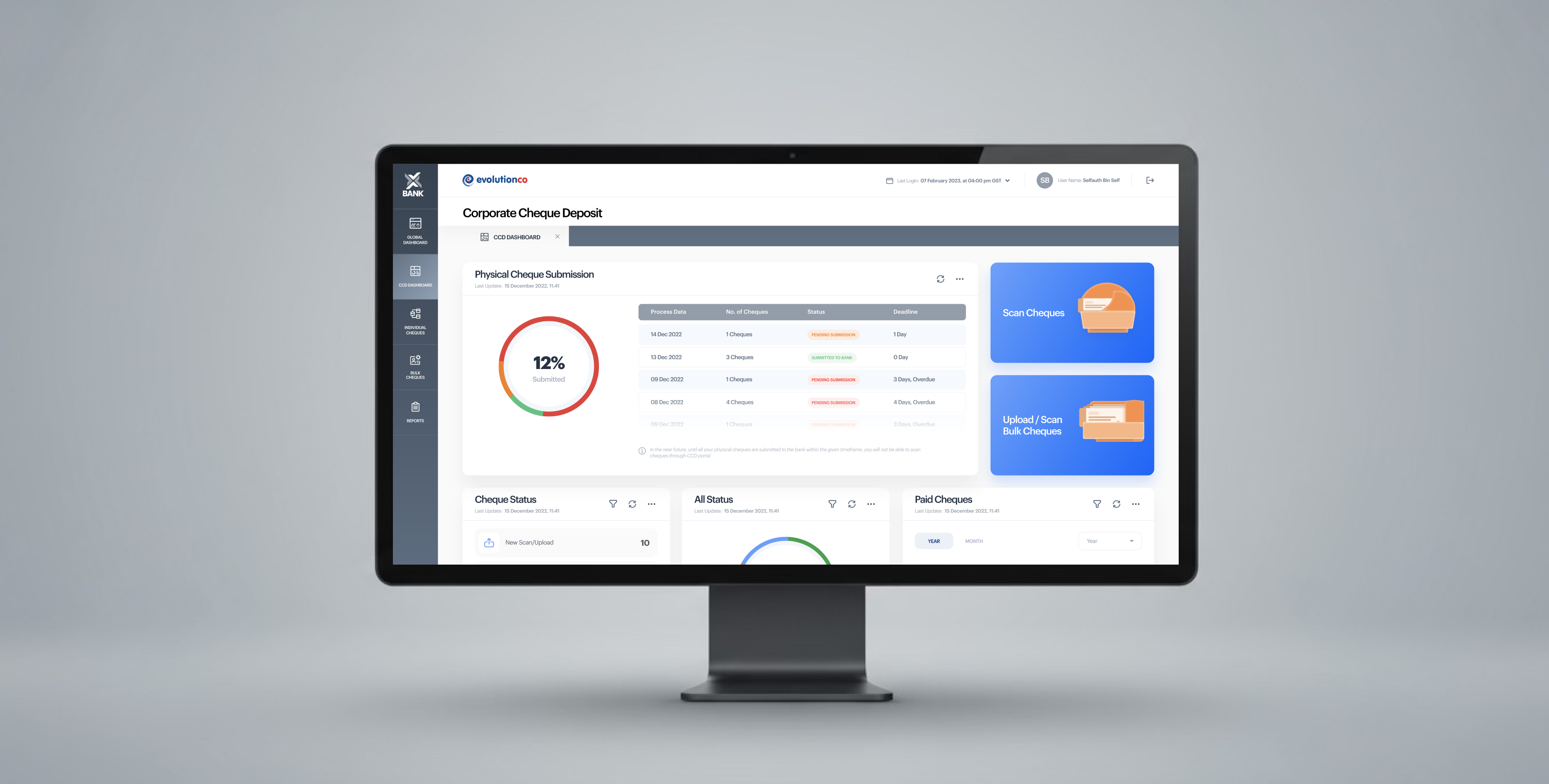

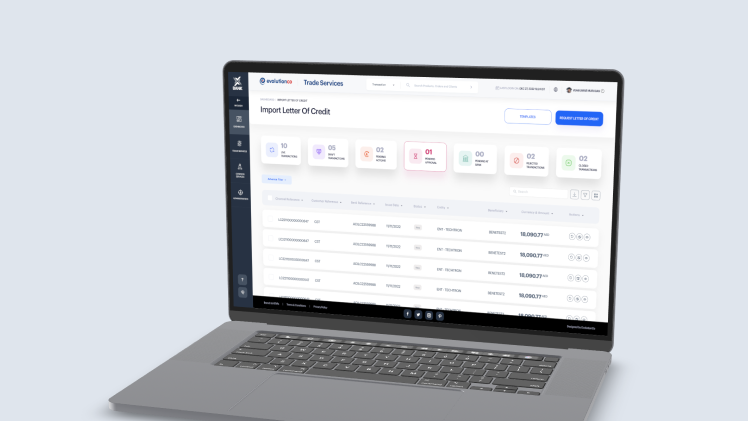

Delivered dashboards covering payments, service requests, account services, and trade. The streamlined design reduced clicks, improved transparency, and set a strong foundation for upcoming modules like Supply Chain Finance, Import LC, Commercial Cards, and Receivables.

Research & Strategy

A structured discovery phase analyzed over 10 modules including Payments, Service Requests, Trade, and Account Services. Workshops with stakeholders and tech vendors identified workflow overlaps, role-based challenges, and data dependencies. This groundwork created clarity on user expectations, business priorities, and the foundation for scalable design solutions.

- Multi-Module Process Analysis

- Maker-Checker Role Mapping

- Workflow Gap Identification

- Business & Tech Alignment

- Data Dependency Mapping

- Scalable Framework

Creative Ideation & Concepts

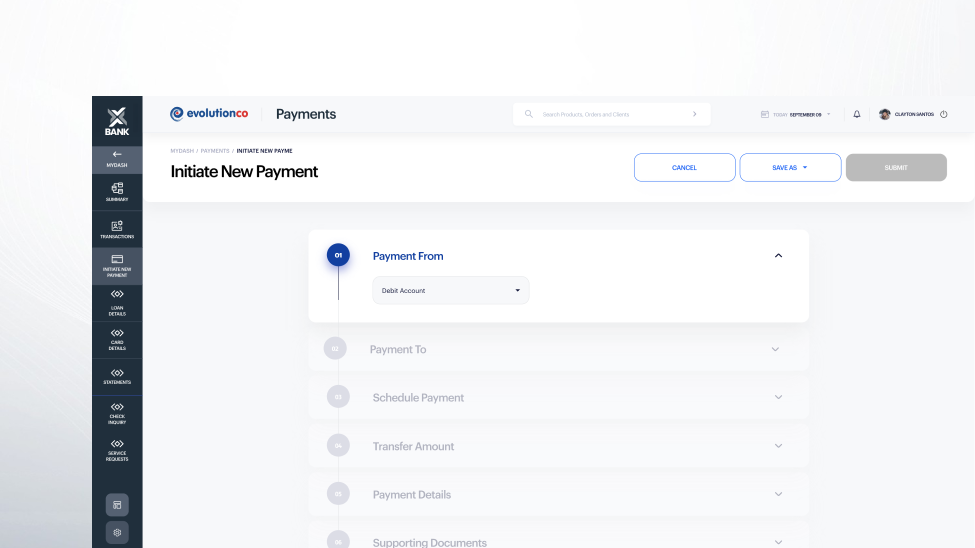

We reimagined fragmented modules such as Payments, Trade, Account Services, Service Requests, and Host-to-Host into unified dashboards and simplified workflows. The design focused on role-based access, actionable insights, and modular scalability, ensuring faster approvals, transparent tracking, and efficient task execution across corporate banking operations.

- Analytical dashboards for Payments, Trade, Account Services

- Simplified Service Request workflows with status clarity

- Role-driven access for Maker, Checker, Verifier, Self-Auth

- Host-to-Host dashboards with seamless integration

- Actionable insights for real-time decision-making

- Modular system adaptable to future products

Prototype & Validation

We converted modules like Payments, Service Requests, Trade, and Account Services into interactive prototypes tested with user roles including Maker, Checker, Verifier, and Self-Auth. Iterative validation sessions refined flows, optimized usability, and ensured stakeholder alignment for scalable, future-ready dashboards. tools.

- LOW-FIDELITY WIREFRAMES & USER JOURNEYS

- INTERACTIVE DASHBOARD PROTOTYPES

- USABILITY TESTING

- STAKEHOLDER REVIEW & FEEDBACK LOOPS

- ITERATIVE DESIGN & FLOW REFINEMENT

.png)

Visual Design & System

The visual design system unified diverse modules like Payments, Trade, and Service Requests into a consistent interface. Built with reusable components and scalable grids, it simplified complex workflows while ensuring clarity, trust, and modern usability for corporate users across dashboards.

- SCALABLE DESIGN SYSTEM WITH REUSABLE COMPONENTS

- CLEAN VISUAL LANGUAGE

- RESPONSIVE GRID & FLEXIBLE LAYOUT STRUCTURE

- CONSISTENT ICONOGRAPHY & TYPOGRAPHY HIERARCHY

- COLOR SYSTEM CONVEYING TRUST & MODERNITY

Measurable

Success

Improved Journeys

Faster Implementation

Increased Adaptability

Stakeholder Alignment

Related

Transformation Stories

Jio World Center | NMACC

Axis Bank | Credit Card

GIB | API Banking

Send a Message

Contact Us