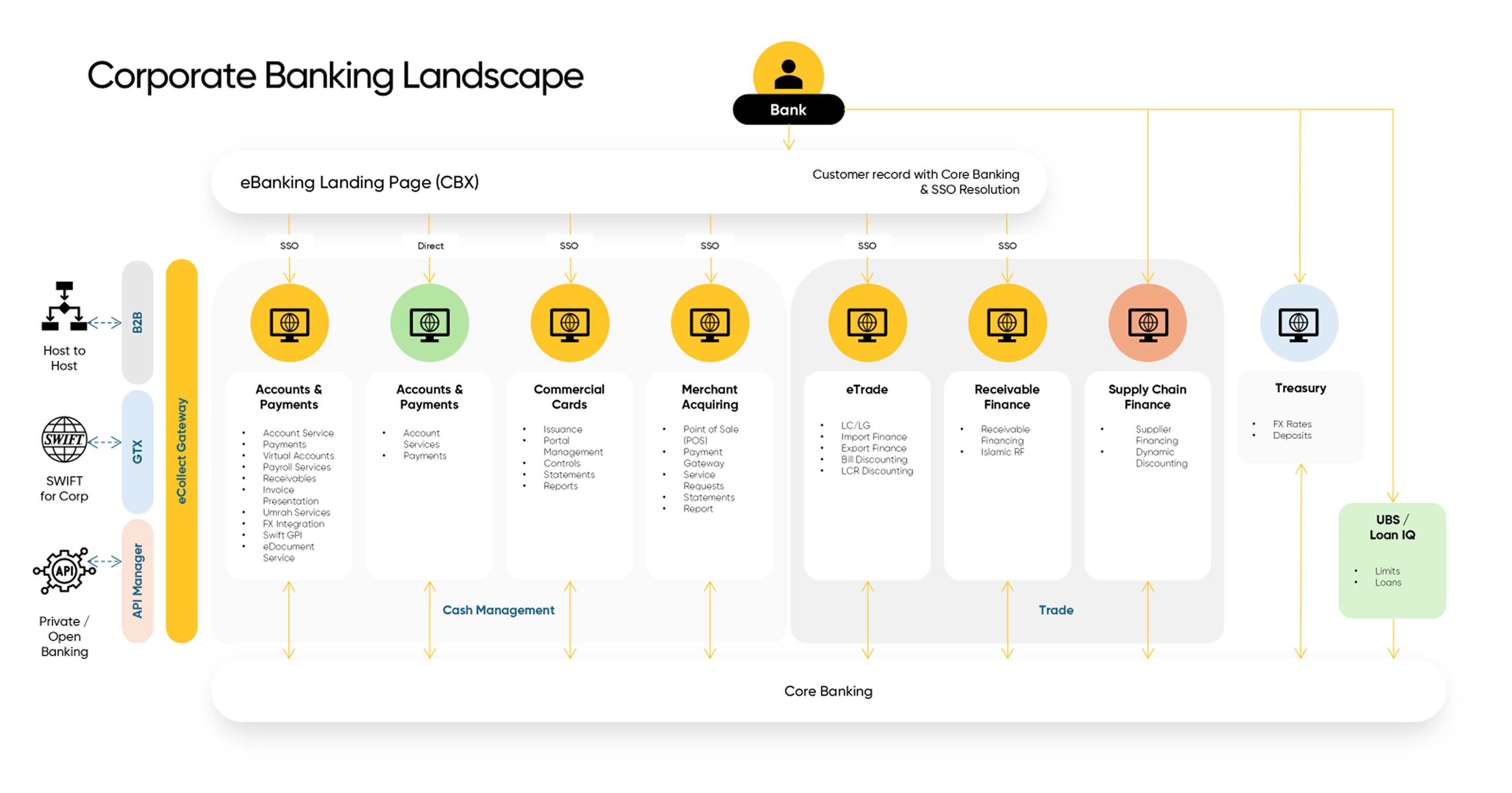

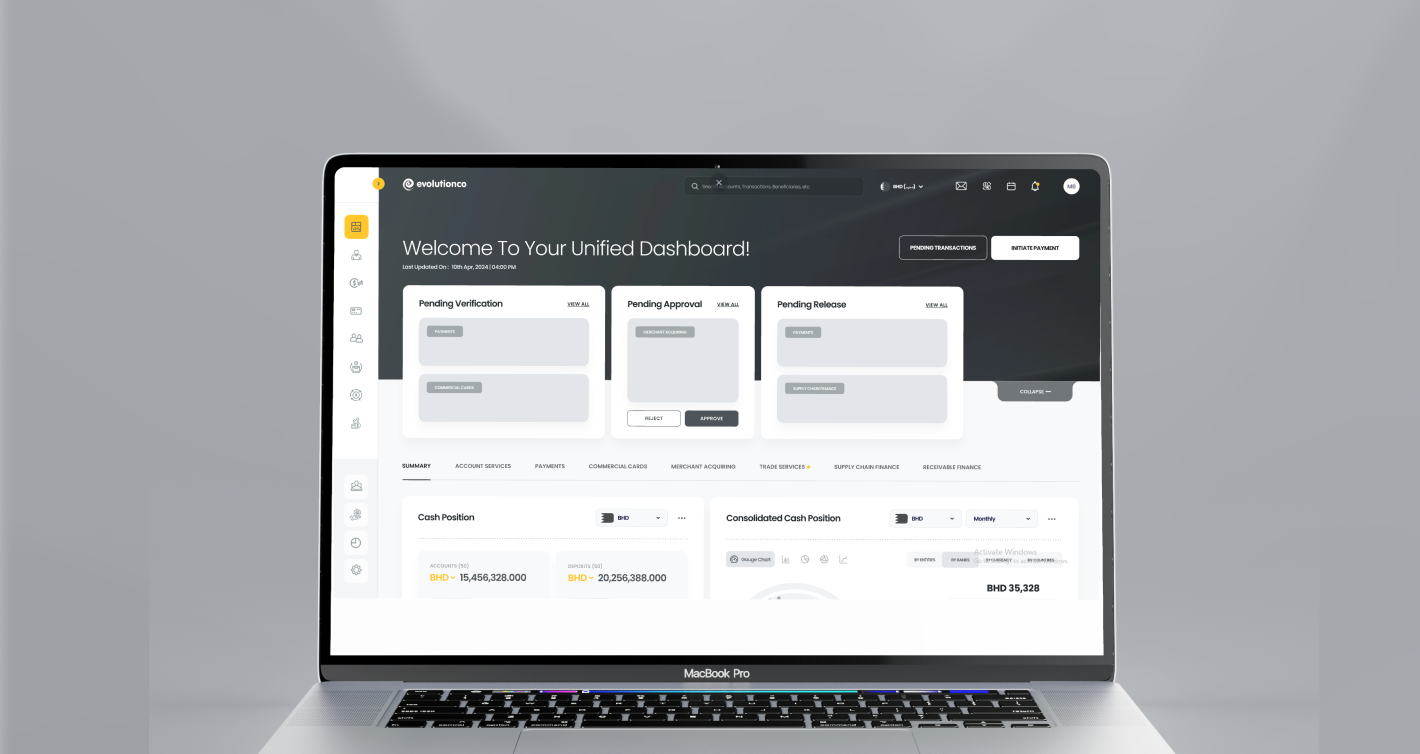

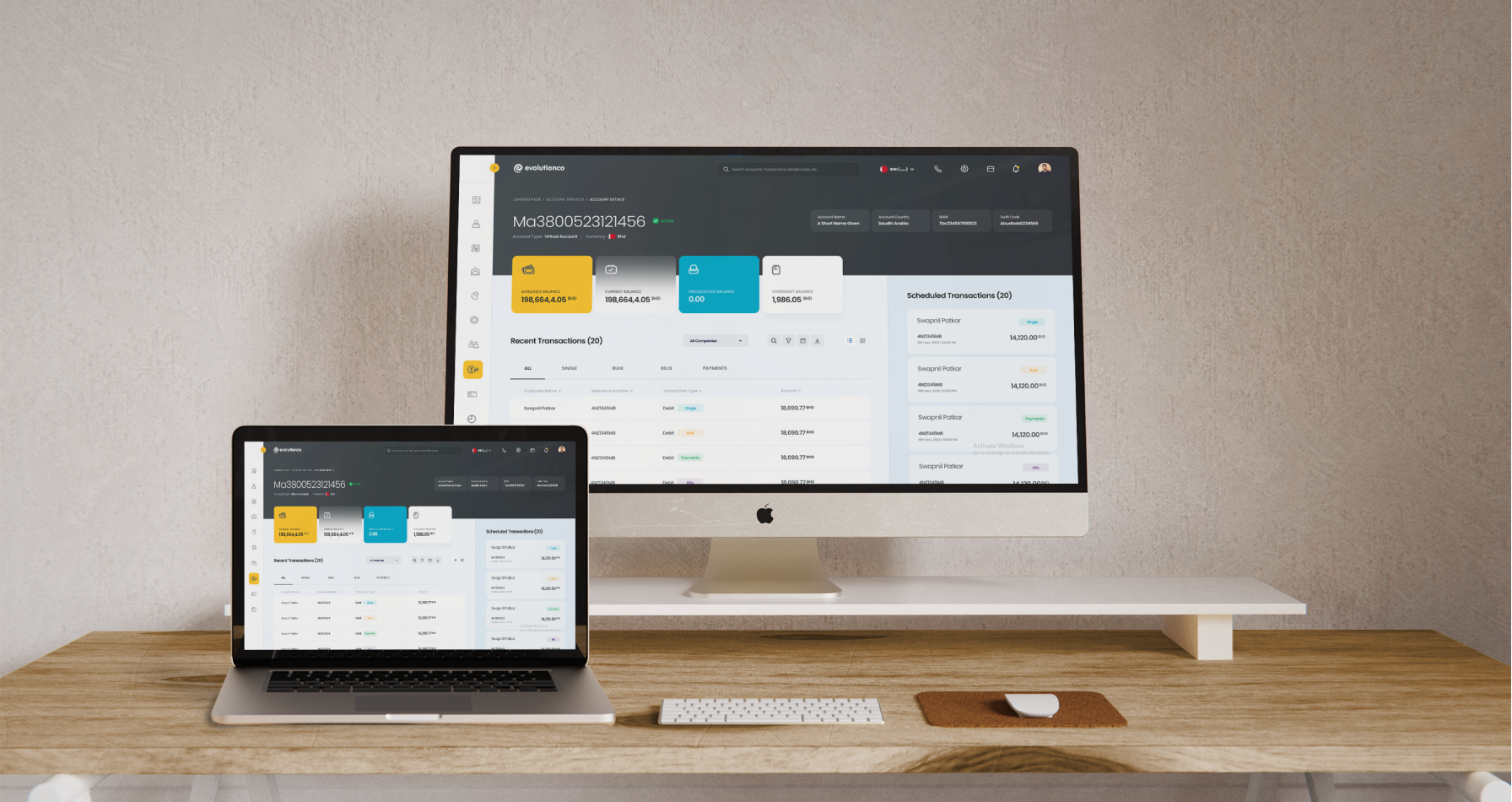

The project focused on a leading GCC financial institution offering a broad suite of corporate banking solutions, including payments, account services, trade finance, and treasury. The aim was to streamline workflows and create a unified corporate banking platform delivering actionable financial insights tailored to varied user personas.

Strategic

Transformation

THE CHALLENGE

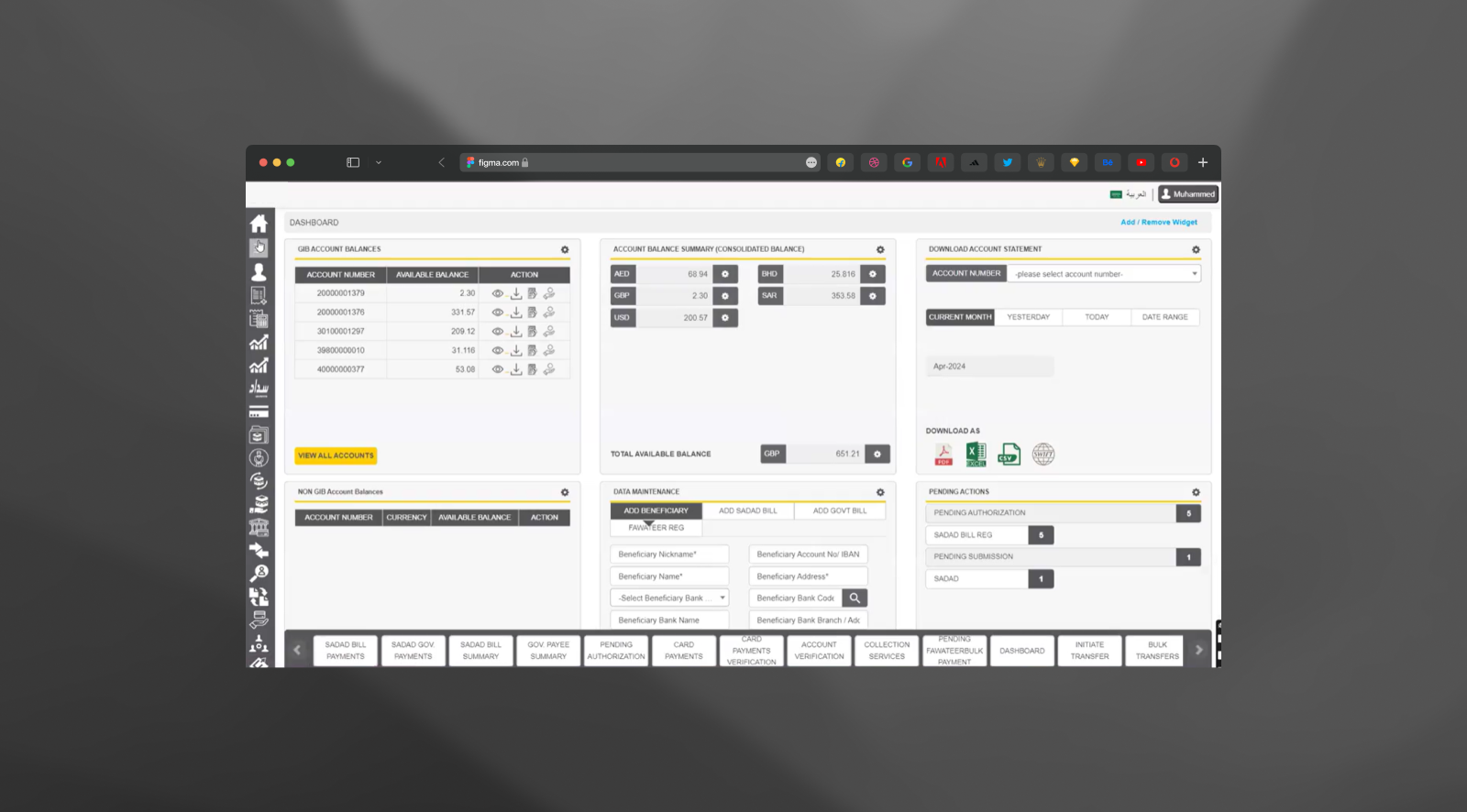

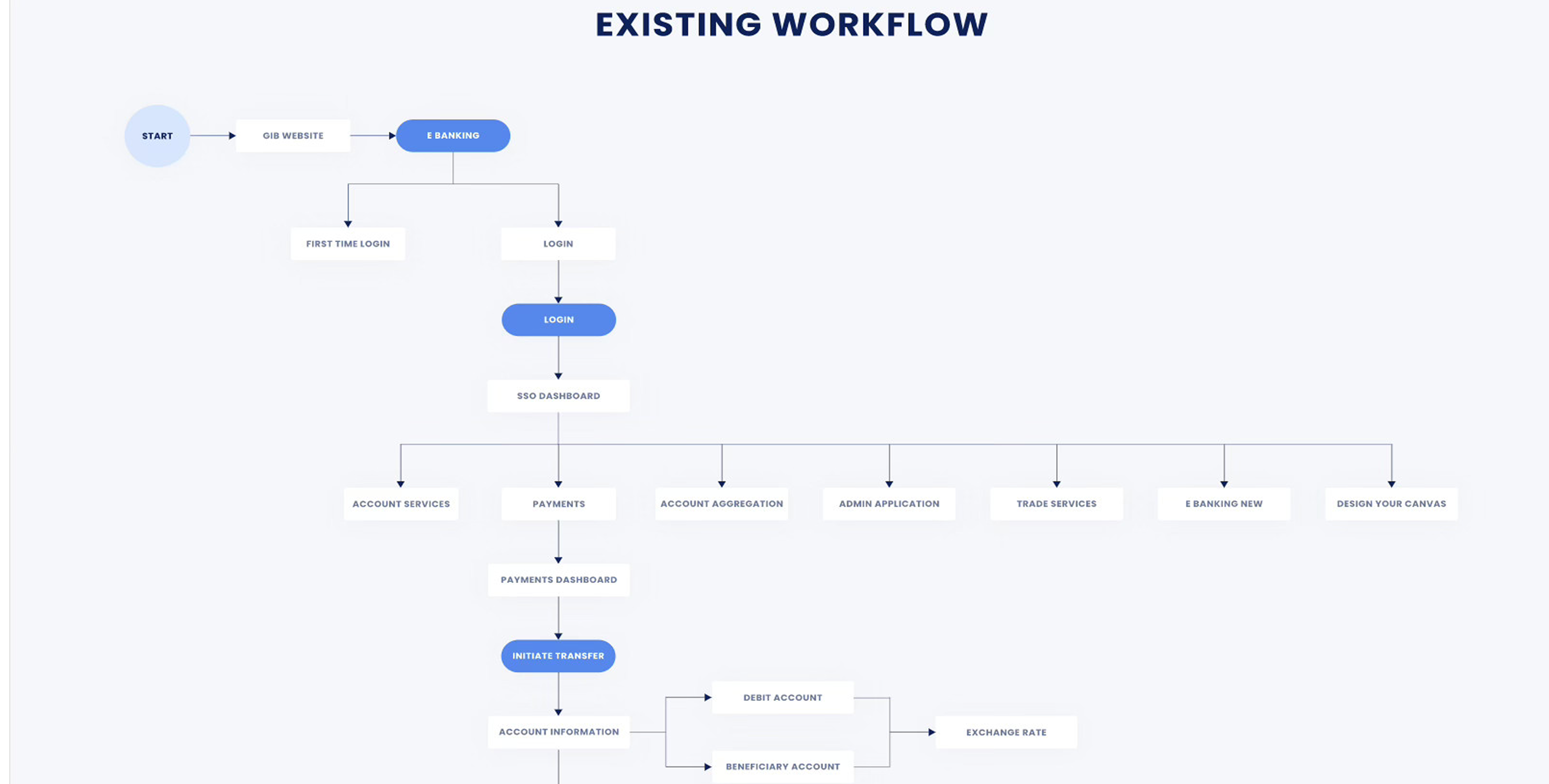

The existing corporate banking platforms were fragmented across modules, leading to inconsistent experiences for users. Complex workflows, scattered journeys, and limited personalization made navigation difficult. Without dashboards or actionable insights, users struggled to efficiently access banking services and complete tasks seamlessly.

THE GOAL

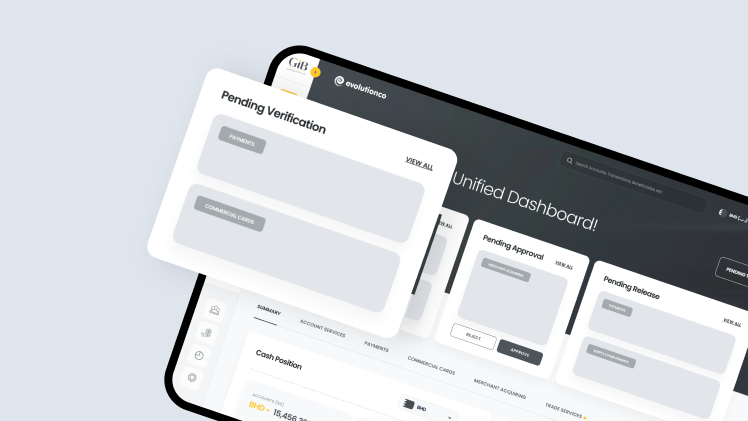

Design a unified, persona-driven banking platform that streamlines fragmented services, enhances usability across modules, and delivers actionable financial insights to empower users with smarter, seamless workflow

OUR APPROACH

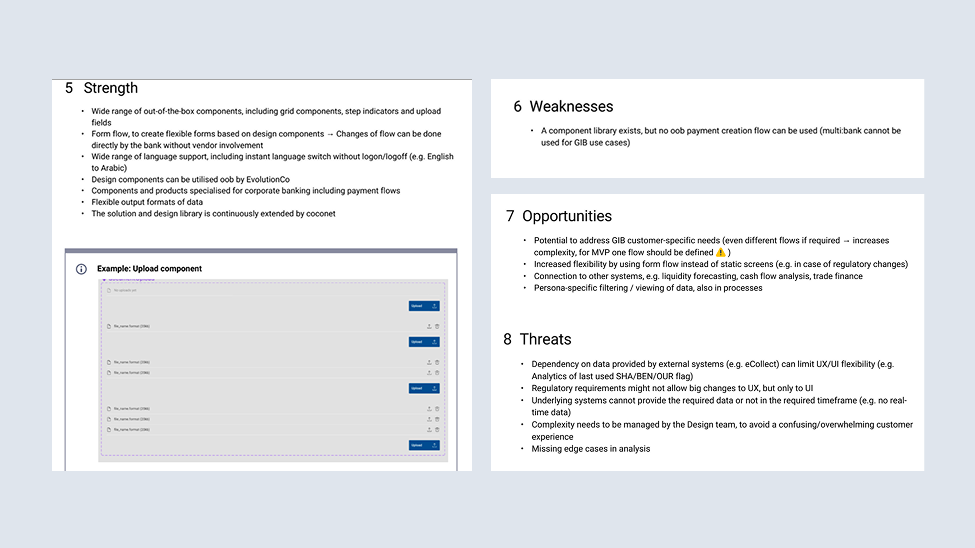

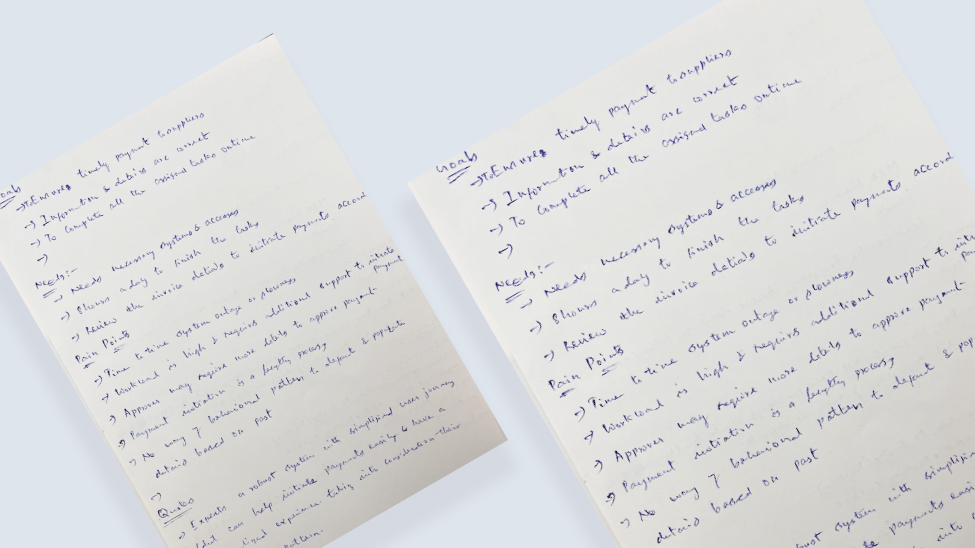

We conducted an intensive discovery workshop with business stakeholders and the client’s tech vendor to uncover pain points and aspirations. Through collaborative mapping of user flows and requirements, we identified opportunities to unify services, streamline journeys, and design a future-ready platform experience that meets diverse corporate banking needs.

THE OUTCOME

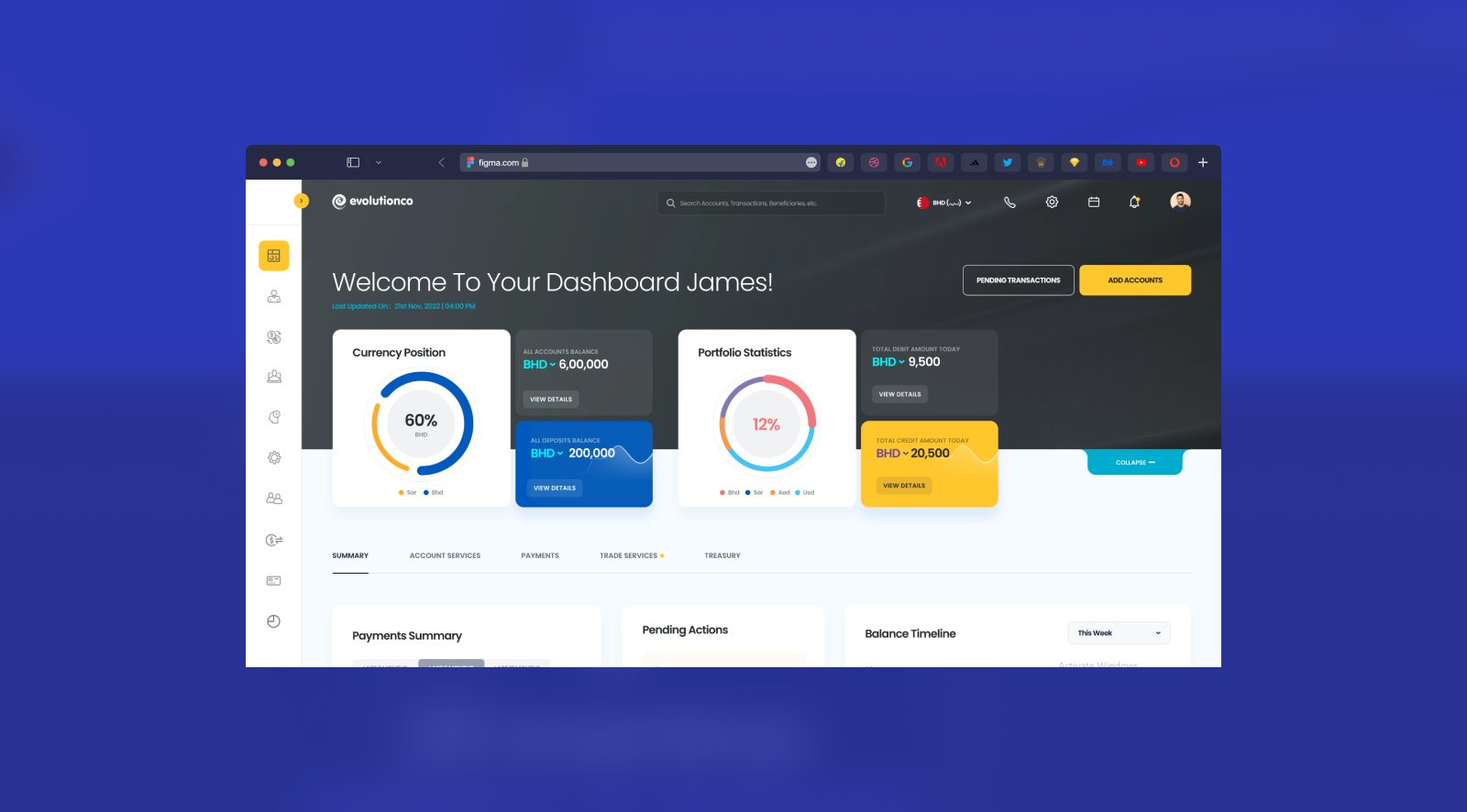

We designed seven dashboards across modules and mapped key user journeys for account services, payments, self-administration, and login. The streamlined experience unified fragmented services and set a strong foundation for future modules like Commercial Cards, Merchant Acquiring, Trade, Supply Chain and Receivable Finance.

Research & Strategy

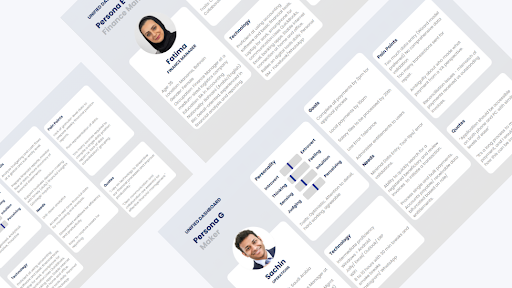

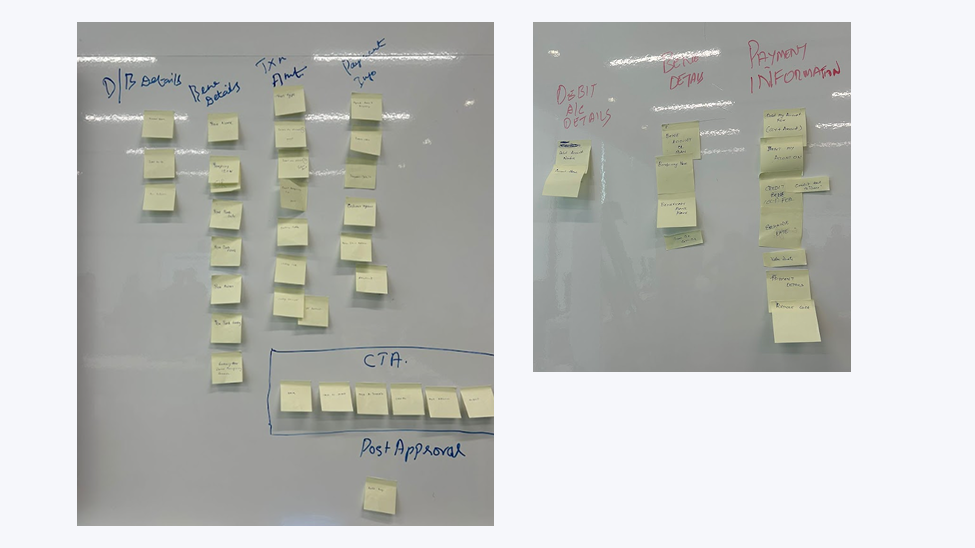

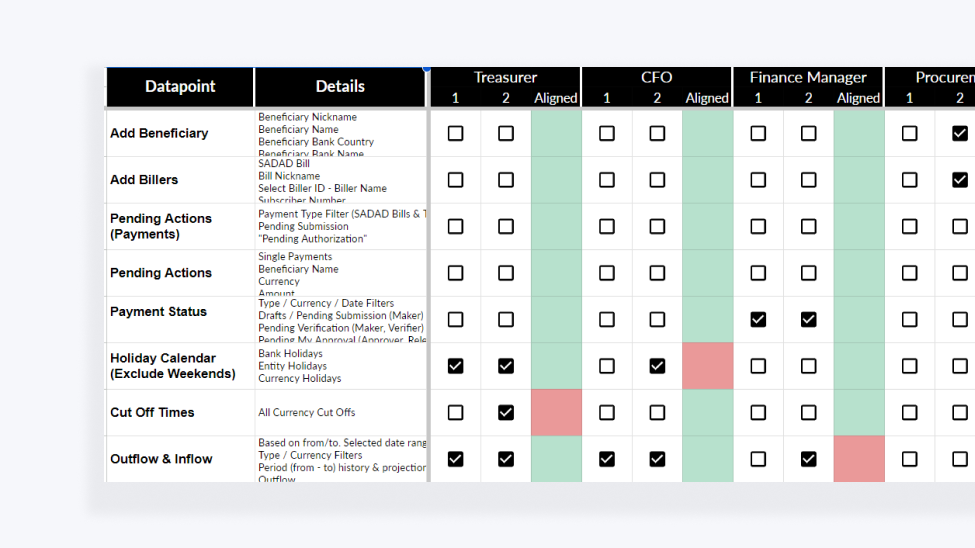

We conducted an in-depth 20-day workshop with business stakeholders and the tech vendor to align on challenges and opportunities. Eight user personas were studied in detail, and proposed journeys across account services, payments were mapped. This collaborative process uncovered workflow gaps, refined business priorities, and set a clear foundation for design solutions.

- DISCOVER & DEFINE WORKSHOP

- USER RESEARCH & PERSONA IDENTIFICATION

- PROPOSED USER FLOWS MAPPING

- TECHNICAL FEASIBILITY & REQUIREMENTS SPECIFICATION

- DATA POINTS MAPPING

- INFORMATION ARCHITECTURE & DESIGN FRAMEWORK

Creative Ideation & Concepts

Dense technical and financial journeys were reimagined into streamlined dashboards and product flows. The experience design emphasized quick comprehension, trust, and decision-making ease for both business stakeholders and clients

- Unified dashboards for 7 core modules

- Simplified product journeys for account services & payments

- Clear navigation flows with minimal cognitive load

- Interactive prototypes for faster stakeholder alignment

- Modular design system adaptable across use cases

- Trust-driven visuals aligned with industry standards

Prototype & Validation

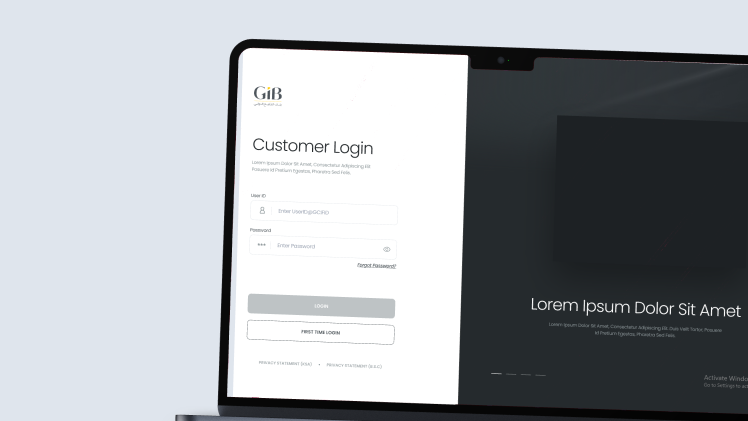

We translated strategy into high-fidelity prototypes that brought journeys to life for business stakeholders and users alike. Through iterative reviews and validation sessions, we refined flows, ensured usability, and aligned with both business stakeholders and user expectations.

- LOW-FIDELITY WIREFRAMES & USER JOURNEYS

- INTERACTIVE DASHBOARD PROTOTYPES

- USABILITY TESTING

- STAKEHOLDER REVIEW & FEEDBACK LOOPS

- ITERATIVE DESIGN & FLOW REFINEMENT

Visual Design & System

The visual system balanced a clean, corporate aesthetic. Designed for scalability and ease of maintenance, it reinforced the bank's positioning as a forward-looking bank while ensuring intuitive usability across complex corporate workflows.

- SCALABLE DESIGN SYSTEM WITH REUSABLE COMPONENTS

- CLEAN VISUAL LANGUAGE

- RESPONSIVE GRID & FLEXIBLE LAYOUT STRUCTURE

- CONSISTENT ICONOGRAPHY & TYPOGRAPHY HIERARCHY

- COLOR SYSTEM CONVEYING TRUST & MODERNITY

Measurable

Success

Faster navigation

Flows mapped

Higher analysis & insights

Stakeholder alignment

Related

Transformation Stories

Jio World Center | NMACC

Axis Bank | Credit Card

GIB | API Banking

Send a Message

Contact Us